We priced thousands of aftermarket service parts increasing margins by 6-8% in very volatile markets

Key Business Challenges

- Brazil market perceived OEM’s pricing for most products to be uncompetitive, significantly higher than competitors’. Cost + plus pricing approach of the past led prices to be out of line with market

- OEM did not have good access with Brazil’s end users. Distributors had better access, while wholesalers serve the biggest segment of price sensitive customers

- Large part of Brazilian sales are for imported (>50%) products leading to a significant exposure to exchange rate fluctuations

Client Expectations

- We identified some specific areas for focus/ improvements by reviewing Brazil business profitability

- Analytics support for quarterly review, Facilitate Performance and action planning with relevant stakeholders

Competitors Analysed 10+

Analytics/Consulting Project

- Segmented actively managed parts and the rest. Identified and coached regional teams on new pricing method

- Collected & validated product pricing data incl. historical sales, technology, customer specs. Etc.)

- Collected market correction info to price Analytical Managed parts

- List price & street price calculations with taxes and channel markups

- Deeper understanding of Brazil’s competitors, customers, channel partners. Benchmarked clients Brazil street prices vs. competitors’ prices

- Evaluated profitability impacts of FOREX (foreign currency exchange) rate changes on imported products

Volumes 30,000+ products/ quarterly pricing correction 5000+

SUMPURA Delivered Outcomes

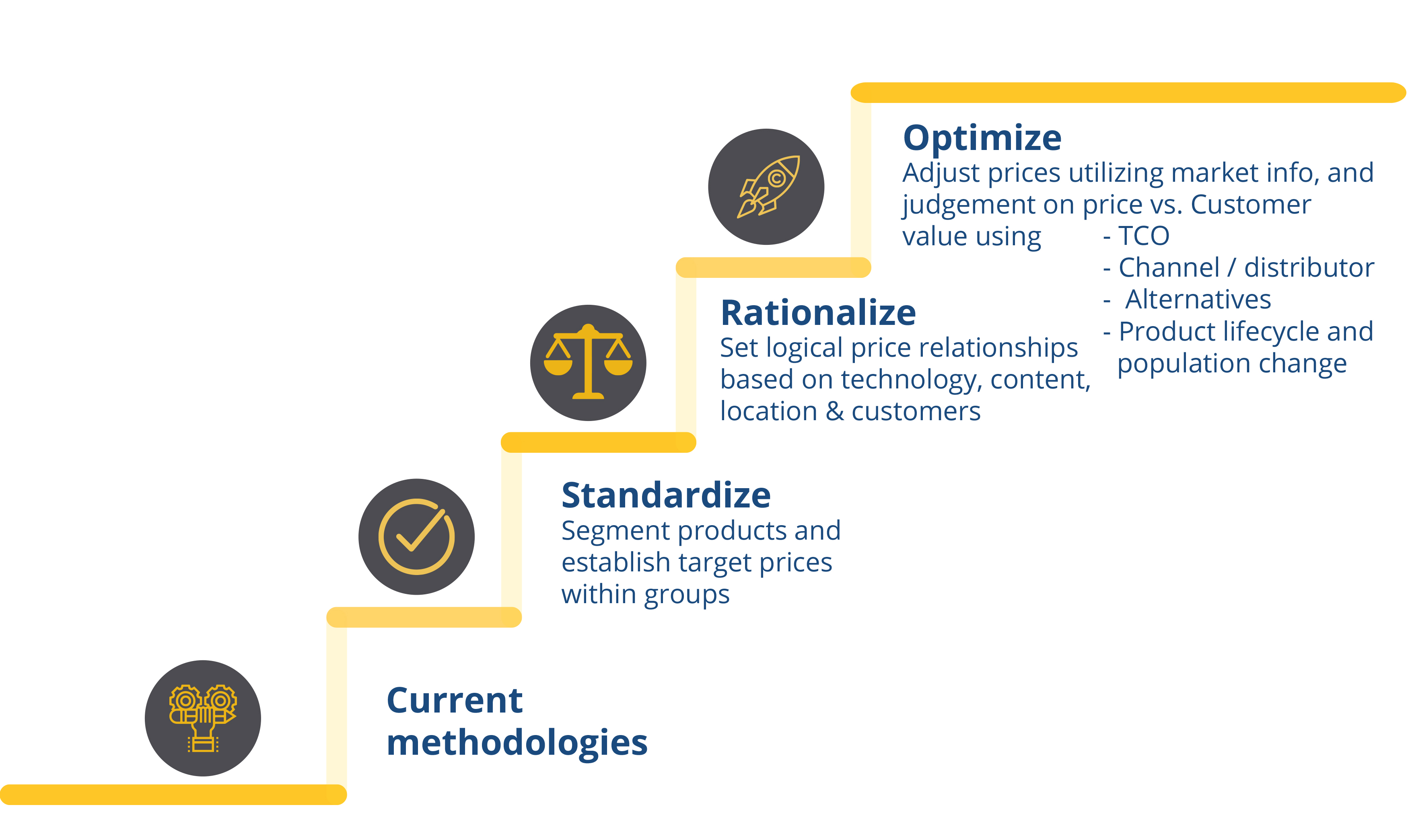

- We used our Standardize-Rationalize-Optimize pricing framework for pricing. ‘Growth’ lifecycle products were priced to maximize margins over the next 2 years, while “Legacy” products were priced to increase market share using ‘Street Prices’ comparison of OEM vs. competitors

- We recommended a 2-staged price correction process (1) at the time of annual pricing action and (2) quarterly adjustments based ongoing review of market reaction and exchange rates but are still planning an exchange rate related price correction before the end of year, in addition to the annual price changes

Margin improvements between 6-8%